Alternative Investment Management,

Made Easy!

Comprehensive and intuitive solutions for alternative investment firms.

DIFFERENT MARKETS. SIMILAR NEEDS. SAME SYSTEM

Comprehensive Solutions for Alternative Investment Firms to

Better Manage Operations!

First Rate, a leading provider of financial technology and services to the wealth management industry, recently acquired Vantage Software to expand their market and global impact by leveraging both firms’ capabilities.

First Rate Vantage offers private equity, venture capital, and real estate advisors one single source of truth in managing a fund’s life-cycle and reporting on private investments including deal flow management, partnership accounting, and investor reporting. Click the appropriate box below to learn how Vantage can help you!

Private Equity

Manage the life-cycle of a fund with tools and reporting for both GPs and LPs

Real Estate

Account and report on all phases of both direct and fund investments

Venture Capital

Manage investments and carry out due diligence with simple workflow.

Consulting

Monitor and report on mandates, manage fund-of-funds for institutional clients

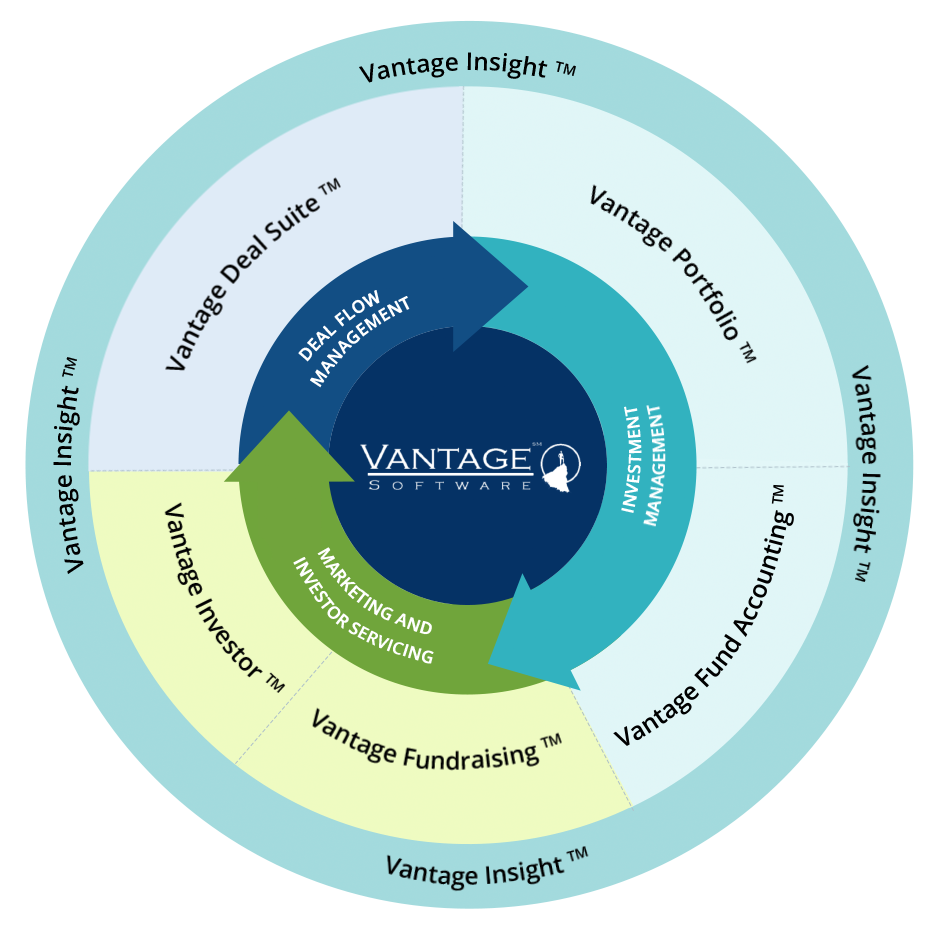

Vantage Product Suite

Vantage’s investor portal enables investors & investment managers to monitor activity and report on investments while providing near real-time communication between investor & manager.

Vantage’s deal manager streamlines the stages of a deal, enhances due diligence, reduces costs, and expedites the deal flow process.

Vantage’s partnership accounting manages all of the complex transactions and accounting from both a GP and an LP perspective, as well as for all types of single- and multi-class partnerships.

Vantage’s fundraising portal automates investor onboarding by reducing clerical errors, speeding funding, and ensuring compliance with KYC (Know Your Customer) requirements.

Vantage’s Research Management Solution is a consolidated repository that improves sharing of investment research by consulting and advisory firms.

Our Clients